Are you interested in finding the best bank accounts for vanlife, RVing, and nomads. Finding the perfect bank account to fit our nomadic lifestyle was actually a bit of a challenge. We had bank accounts from before vanlife, and we found that none of them perfectly fit our needs. And we found that even the “big banks” weren’t present in more remote areas of the country. When you are constantly on the move, you need a bank that you can use no matter where you are. Whether you need to mobile deposit a check, use an ATM, or simply transfer money to other accounts.

And in addition to that, you still want an account that earns competitive interest with no overly-punitive fees or restrictive minimums. We found that many banks are geared towards people with a more stable income and consistent banking needs. But we have found that life on the road requires more financial flexibility. So we took a hard look at some of the highest-rated bank accounts to see which ones are the best bank accounts for vanlife, RVing, and nomads.

Unsurprisingly, it’s often the new style of online-only banks that serve the needs of nomads better. Gone are the days when you choose a bank with a branch near your house, and you go there in person for all your banking needs. The growing crop of online-only banks proves that many people are moving away from the traditional brick-and-mortar banking system. They nearly always offer amazing mobile apps that allow you to manage all your banking needs right from your phone. And they often boast more forgiving terms like; no monthly fees, no overdraft fees, and no minimums. I find these perks to be much appreciated when you are living an unpredictable lifestyle.

These online-only banks have much less overhead than traditional banks because they literally don’t need to own and operate a bunch of branches around the country. And they typically pass that savings onto customers in the form of extremely high-interest rates. Growing up I remember the pitiful .01% APY (annual percentage yield) my Bank of America account had.

However, to qualify for these awesome interest rates, you often have to meet some requirements, which I explain below for each institution. And the other main challenge of some online-only banks is the limited options for depositing cash or checks. Depending on your job and your types of income you may prefer one method over another. For example, lots of remote work jobs for vanlife won’t deal with any cash but, on the other hand, seasonal jobs in the service industry could include lots of cash tips.

So your specific banking needs might be different than ours. But here are some of the unique banking challenges we have encountered while living on the road.

Banking Challenges When Living On The Road

We have picked up tipped jobs in remote areas, which leaves us with paychecks and a bunch of cash in places where there are very few ATMs or even banks in general.

Depositing Checks

Luckily, most jobs offer direct deposit these days. But one employer we had in Idaho did not. So in that case, it was essential to have mobile check depositing. But admittedly, most banks now offer this service, so that’s not much of a hurdle anymore.

Depositing Cash

But the more challenging thing is finding a place to deposit cash. If you have an account with one of the “big banks” like Chase, Wells Fargo, Citi, and Bank of America, then you can use one of their ATM’s. But we’ve been in places where the nearest ATM or branch for those banks was over an hour away. So we needed to find a better way to deposit our cash.

The best method we found for depositing cash was to purchase a money order from the post office. Even the most remote towns typically have a post office. For $2 you can buy a money order and deposit up to one thousand dollars. So having a bank that allows you to mobile deposit money orders is a nice perk.

Banks may also allow you to deposit other types of checks, like cashier’s checks, but they usually cost between $8-$20 each.

Finding ATMs

Many online-only banks don’t actually have their own ATMs but rather have an agreement with other banks to provide their customers access to their ATMs. It’s often called a shared ATM network, and it can actually provide you access to ATMs all over the country. In our experience, these networks of shared ATMs are often equal to or better than the ATM network of some of the big banks.

Low Spending and Low Balances

Some banks require a certain amount of spending or account balance to qualify for certain perks. It’s not uncommon for vanlifers to have low monthly spending that prevents them from getting the perks. Or you may need to carry a balance within a certain range to qualify for earning interest.

Must Receive Monthly Direct Deposits To Qualify For APY (Annual Percentage Yield)

We often work seasonal jobs to sustain vanlife travel and take months off in between. However, our blog generates monthly income, but it’s not always consistent. All of which means that our income is quite variable. Many banks require that you receive a direct deposit each month in order to qualify for APY. So if you’re someone who likes to take months off work with no income, then you may not qualify for interest in those months.

Checking Versus Savings Accounts

Every bank I cover below has some version of a savings account that you can pair with their checking account. Typically you can manage the checking and savings right from the same interface. Generally, the interest earned for savings is higher than for the checking account. And transferring money between the two is easy and instantaneous.

Since it’s not very productive to repeatedly mention the same services offered by every bank, I mostly stick to describing what sets them apart. But first, here are the things that all these bank accounts have in common (unless otherwise noted); no monthly fees, no account minimums, no overdraft fees, a mobile app, mobile check depositing, a free debit card, no ATM fees (in-network), and your first checkbook free.

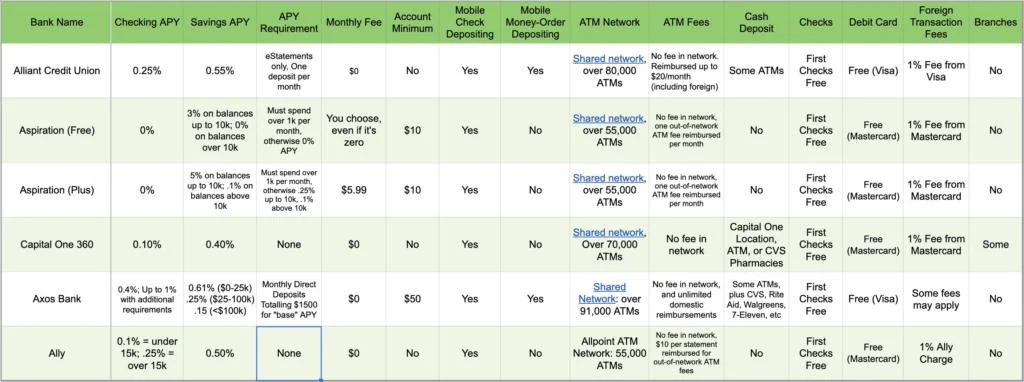

So now let’s get into the details that set these bank accounts apart from one another. I made this helpful spreadsheet below to easily compare the best bank accounts for vanlife. It may be hard to read depending on the size of your screen, click here to view the spreadsheet itself for a closer look.

Comparison Chart | Best Bank Accounts For Vanlife, RVing, & Nomads

Alliant Credit Union

Checking APY: .25%, Savings APY: .55%

Let’s begin with our top pick, the bank that I am using right now. Alliant Credit Union is an online-based credit union that has earned its place as one of the best bank accounts for vanlife, RVing, and nomads. It literally combines all the things that are most important to us, and yet still provides a great APY (Annual Percentage Yield). It has one of the highest APY for checking, so even without diligently moving money to your savings account, you still earn decent interest from checking.

One of the things I like about Alliant is just how simple it is. Everything is straightforward with simple rates and no complicated tiers or requirements. The only two requirements to qualify for APY on any given month are to be signed up for eStatements, and receive one electronic deposit each month (e.g., a direct deposit, payroll deposit, ATM deposit, mobile check deposit or transfer from another financial institution).

And when it comes to depositing cash, Alliant Credit Union has you covered. They have a shared network of ATM’s, a good amount of which accept cash deposits. And in addition to mobile check depositing, Alliant has the ability to mobile-deposit money orders, a unique feature that is a cheap way to deposit cash from remote areas.

Like pretty much all online banks, Alliant has a mobile app to manage your money entirely from a phone. Their mobile app is on par with many of the others out there, but has one awesome feature I really like. Without even logging into your account, you can see your checking and savings balance right on the login screen, plus the location of the nearest in-network ATM. It’s a subtle feature, but it’s really nice if all your want to do is check your balance or find an ATM real quick.

Verdict: Alliant Credit Union is currently our top pick for best bank accounts for vanlife. It has various options for depositing cash and checks, and it offers great APY rates for both savings and checking. And the requirements to qualify for APY are simple and easy.

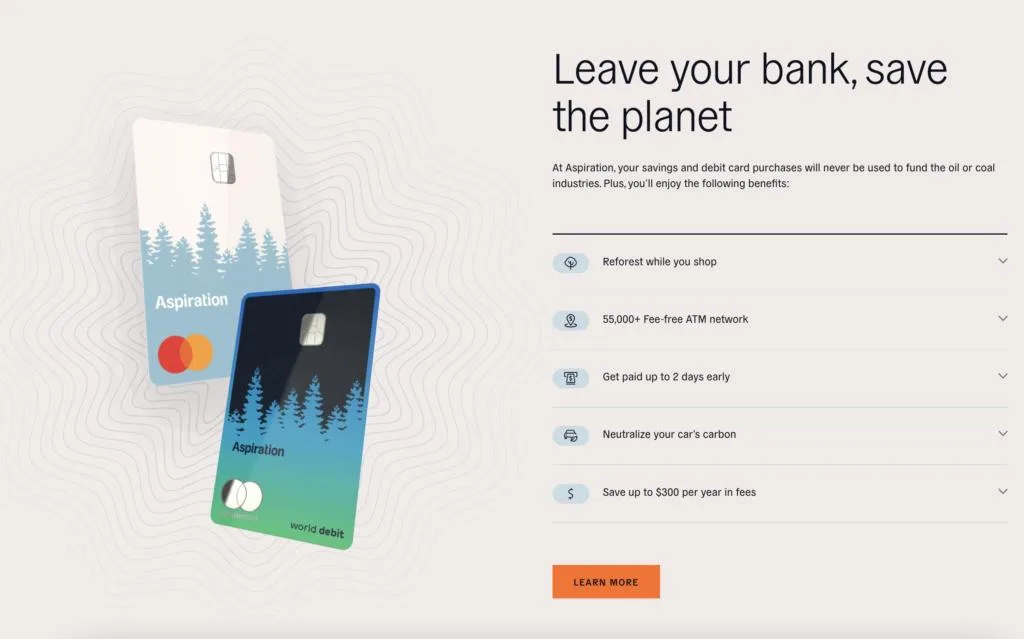

Aspiration Spend & Save

Checking APY: 0%, Savings APY: tiered system between 0%-5%

Aspiration is an online-only bank with an environmental conscience. When people give their money to a bank, they don’t often think about what that money gets used for. And Aspiration wants everyone to know that “The four biggest global bankers of fossil fuels are all U.S. banks — JPMorgan Chase, Wells Fargo, Citi, and Bank of America.”

Aspiration is creating a financial firm built for the planet. No money from Aspiration goes to funding fossil fuels. Their environmentally-focused programs involve things like offsetting carbon, planting trees, and helping you track the environmental impact of where you shop. The idea of offsetting the carbon of every mile driven is one unique reason that Aspiration is one of the best bank accounts for vanlife, RVing, and nomads.

But Aspiration no longer offers cash deposits, which is a huge dealbreaker for many nomads.

Aspiration’s checking and savings account pairing is called Aspiration Spend & Save, respectively. The base version of Aspiration Spend & Save has a unique “pay what is fair” model. They basically let you choose what you want to pay for a monthly fee, even if it’s zero. The Aspiration Spend & Save Plus equates to $5.99 per month (if paid annually) and comes with lots of perks.

Aspiration has some really insane APY interest rates (savings only), but there are somewhat complex tiers and requirements to qualify. But I’ve done the math to figure out who stands to benefit the most from their high-interest savings accounts.

APY for Aspiration Standard Savings Account (Pay what is Fair)

Under $1000 spend = no interest

Over $1000 spend = 3% on balances up to 10k, 0% on balances above 10k

3.00% APY is a very high interest rate, however, many van lifers spend less than $1000 per month, especially when their total checking/savings balance is less than 10k. So for us, that tempting APY just isn’t really attainable unless we combine all of your spending into just one account.

APY for Aspiration Plus Savings Account ($71.88 annually)

Under $1000 spend = .25% on balances up to 10k, .10% on balances above 10k

Over $1000 spend = 5% on balances up to 10k, .10% on balances greater than 10k

If you CANNOT meet the $1000 spend per month, then you are not going to even break even on APY vs the annual fee. For reference, $9,000 x .25% APY = $9,022.53, and again the annual fee is about $72.

If you CAN meet the $1000 spend per month, then you will be rewarded handsomely with that insane 5% APY.

Consider that even with only $1500 in your account at the beginning of the year, you will already make more in interest ($76.74) than the annual fee ($71.88). And with a higher balance, it’s even better.

If you start the year with $9000, then for example $9000 x 5% APY = $9,460.46.

To earn over $460 dollars in interest on a balance like that is pretty amazing. But of course, that’s about as good as it gets because once you pass that 10k threshold, it comes back down to a modest .10% APY.

Next, we’ll calculate the over 10k APY for reference.

Say you start the year with 10k in your account, then you are only going to make $10 per year, which is obviously less than the $72 annual fee. It’s not until you have 72k in your account that you will make back the annual fee in interest.

Bottom line is that if you don’t spend over $1000 per month, then Aspiration is not a good fit for you (at least in terms of maximizing APY). If you do use Aspiration, it’s best to keep your balance below 10k. Your best move would be to transfer your money to a different bank account to ensure that you stay around that 8-9k sweet spot.

Note: The $1000/mo spending requirement does not include things like Venmo, CashApp, Facebook Pay, etc.

Other Perks with Aspiration Plus

Cash Back At Conscious Coalition Companies – Customers earn cashback on purchases made at Conscious Coalition merchants (10% cashback with Aspiration Plus, 3.5% cashback with Aspiration Free).

Plant Your Change – An optional program where Aspiration rounds up your debit card purchases to the nearest dollar and invests that money in planting trees. It’s a really great program that certainly is and will help make an impact. But essentially, Aspiration is just taking your money and putting it towards a good cause for you. You will have to decide if that’s something you want to opt into.

Carbon Offsets – Aspiration will purchase carbon offset credits for all gas purchases you make with your Aspiration debit card. This feature can essentially make the driving you do carbon neutral. This feature might actually be quite appealing for people driving around large campervans and RV’s. However, if you are used to earning cashback by using a credit card on all your gas purchases, then you are losing out on those points by moving that spending over to a debit card, something to consider.

Verdict: Aspiration is the best for insane savings account APY rates, and has a unique commitment to banking that’s good for the planet. The catch is their somewhat restrictive requirements to qualify for the best interest rates. But the bottom line is that If you spend over $1000 per month, then Aspiration will reward you better than any other bank, period.

But ever since they lost their partnership with cash-deposit accepting ATMs, they aren’t a perfect fit for many vanlifers, RVers, and nomads.

Capital One 360 Checking

Checking APY: .10%, Savings APY: .40%

A Capital One 360 Checking account is one of the best bank accounts for vanlife if you prefer a bank with some physical branches. In my opinion, the 360 Checking account seems like a direct response to the emergence of high-yield online-only banks. Capital One created a financial product that can compete with the other “high-yield, no fees, no minimums” type of checking account that many consumers are choosing.

Capital One 360 Checking has pretty competitive interest rates, and no pesky requirements in order to qualify for interest. This can be a nice perk for people with very unpredictable finances, who don’t want to worry about spending requirements, account balances, or monthly direct deposits. No matter what, you will earn interest on both checking and savings.

And unlike all the other banks on this list, Capital One does actually have its own physical locations, cafés, and ATMs that you can visit to deposit cash. The Capitol One cafés seem like another attempt by a giant corporation to be ‘chill’. “We’re not a bank, we’re just a chill place to come kick it bro. Come deposit some money, and while you’re at it, grab a coffee and some free Wifi”. (Though free Wifi is actually pretty nice when you’re living on the road).

But the reality of Captial One Branches and Cafés is they currently only exist in major cities. And in my experience, vanlifers and RVers mostly stay far away from the city centers. So, in practicality, the physical locations may not be all that useful to you.

Luckily they also have a partnership with CVS Pharmacy to allow fee-free cash deposits there too.

Verdict: Capital One 360 Checking is one of the best bank accounts for vanlife, RVers, and nomads. They offer respectable interest rates on their checking and savings with NO requirements to qualify for interest. And they still have some physical branches around the country (albeit limited) if you still like that option. And the ability to deposit cash in ATMs and at CVS locations is a nice feature.

Axos Bank

Checking APY: .4-1%, Savings APY: .61%

Axos Bank is another one of the best high-yield bank accounts for vanlife. It has the highest checking APY of all the bank accounts on the list. Plus, they are one of the unique banks that allows money orders to be deposited through the mobile app. And they allow cash depositing at some ATMs and retail locations. It does require $50 to open an account, but no account balance minimums after that.

Axos has a tiered interest rate system that has the potential to be very rewarding. However, there are numerous requirements to qualify for the highest interest rates.

The base-level APY is .40% for checking and .61% for savings, and all you need to qualify for that is monthly direct deposits totaling at least $1500. The Savings account interest is tiered as follows; 0.61% for balances $0-25k; .25% for balances $25-100k; and .15% for balances greater than $100k.

Then to unlock even better checking interest rates you need to meet other requirements like 10 debit card transactions per month, minimums invested in other trading accounts, and loan payments. If you fit into a few or all of these categories, then you have the potential to unlock up to 1% APY!

Verdict: Axos Bank has some of the best interest rates, especially if you can meet additional requirements. Though personally, we find the requirements a little bit restrictive and personally not the best match for our current financial situation. They also have the unique perk of accepting mobile deposit of money orders.

Ally Bank

Checking APY: .10-.25%, Savings APY: .50%

Ally Bank is another really popular online-only bank. It has pretty competitive interest rates. What’s odd is their checking interest rate tiers; for balances under 15k the APY is .10%, and switches to .25% for balances over 25k. That’s basically the complete opposite of how most banks create their interest tiers. But I suppose that’s a nice perk for people with a larger amount of savings.

And what’s nice is that besides those tiers, there are no other requirements in order to qualify for interest.

The biggest negative of Ally Bank is that there is no way to deposit cash. And for that reason alone, they sink far down in our rankings. But otherwise, they are a very highly-rated online bank.

Verdict: An Ally Bank Checking/Savings Account has great interest rates and no requirements to qualify for them, but their lack of cash deposit methods moves them towards the bottom of the list.

Conclusion | Best Bank Accounts For Vanlife, RVing, and Nomads

Ultimately, these are all excellent, highly-rated checking/savings accounts. With their great interest rates and lack of fees, minimums, and penalties, they all feel like a breath of fresh air compared to banking with the “big banks”.

But vanlifers often have different financial needs than your average person. So that’s why we took a closer look to see how they fit a community with unique financial needs.

Alliant Credit Union and Capital One 360 are our top overall picks because of their various cash deposit options, and great interest rates with little to no restrictions.

If you can meet the requirements of either Aspiration or Axos Bank, then you can unlock some insanely high interest rates. But the lack of cash deposit methods with Aspiration can make it a tough choice as your primary checking/savings account.

I hope this post has helped you find the best bank account for your financial needs.

Help Share ‘Best Bank Accounts For Vanlife’ On Pinterest!

How To Work Seasonal Jobs To Sustain Vanlife Travel - tworoamingsouls

Monday 21st of March 2022

[…] {Related Post: Best Bank Accounts For Vanlife} […]